Making the Case for Staying Invested in Times of Market Volatility

This article originally appeared in Aldrich Community, a client experience offering from Aldrich Wealth.

When times get tough, the tough get going, right? Well, maybe sometimes, but that’s not the case when it comes to investment management. In times of economic and political uncertainty, this common platitude should more accurately be edited to, “when times get tough, successful investors sit tight.” But that’s easier said than done, as many of our advisors can attest. It’s not often a client can view their account with the same objectivity their advisor can, which is understandable. So, why should an investor stay the course and remain invested even during an election year and recession? Below, we’ll explore some of the reasons one might want to do just that.

If you choose to divest and go to cash, you need to time it right twice.

Read that again. If you decide to go to cash, you need to time it right twice. Why is that? Because you must ensure you exit and enter the market at the best times possible. If it sounds tricky, that’s because it is. Even for the most experienced investor, predicting the market’s peaks and troughs is challenging at best.

An apt example of this is the Great Recession of 2008, which hit its trough in 2009. Unfortunately, many people exited the market and moved to cash well into the market pullback. To complicate matters, many didn’t reenter the market but rather waited on the sidelines many years into the bull market. Regrettably, this meant riding the market down and missing some of the best days in the recovery, as often the best days in the market come on the heels of the worst days.

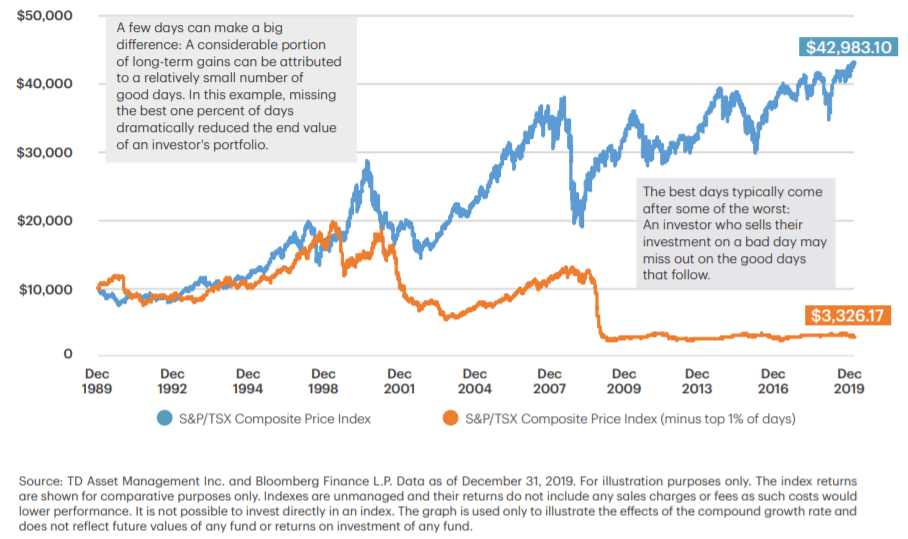

The chart below illustrates the impact of missing the top 1% of the best days over the last 30 years. It’s worth noting that while the graph below tracks the trajectory of an initial investment of $10,000 over the course of 30 years, the negative impact of divesting during the Great Recession is pronounced. Were longer-term investors to remain invested, rather than trying to predict the best time to reinvest, they would’ve recovered much sooner by remaining invested rather than waiting on the sidelines.

Growth of $10,000 – December 31, 1989 to December 31, 2019

This is down the road money, not tomorrow money.

As an alternative to exiting the market wholly, if you need the assets in your portfolio for short-term goals, you may want to evaluate whether you can weather market volatility. Alternatively, if the money is earmarked for long-term goals, like retirement, your portfolio is designed for long-term growth despite short-term declines. A regular evaluation of your short-term cash flow needs and long-term goals can help you decide whether moving to cash is a wise choice in times of heightened volatility. If you work with a financial advisor or planner, you have the additional benefit of someone acting as your partner and guide as you go through different stages in life. At Aldrich Wealth, your advisor and financial planner can steer you in the right direction to ensure that your investment portfolio has the best possible asset mix given your risk tolerance and short- and long-term goals.

The markets are forward-looking.

With the ongoing global pandemic and deeply polarized political landscape, it might seem like an election could create even more unfavorable stock market conditions. Still, it’s essential to remember that market cycles don’t always align with our economic cycles. While there is an interplay between economic policies and performance of various market segments, markets price in expected future fiscal and monetary policy changes and other anticipated outcomes ahead of time. Practically speaking, this means that the stock markets have already priced in timely development of a COVID-19 vaccine, and expected electoral outcomes don’t lend themselves to prolonged market overperformance or underperformance.

Given everything that’s transpired this year, investors’ tendencies to prescribe greater importance to market performance surrounding the election is understandable. However, it is best to keep a long-term view of your financial goals and maintain a well-balanced portfolio that can help you weather whatever volatility may come. Additionally, existing market volatility can present opportunities for you to advance your progress on long-term goals by purchasing equities at better prices. With that said, if you feel your risk tolerance wavering due to recent market volatility, reaching out to your advisor to discuss potentially moving to a more conservative portfolio may be a wise choice.

In conclusion, it’s essential to reflect on why our impulses as investors can lead us astray. As humans, we are inclined to react to quickly shifting circumstances with an eye towards protecting ourselves and our loved ones. It’s no surprise, then, that many investors have responded to the heightened market volatility of 2020 by rushing for the exits during the steep declines. As advisors, our goal is to provide the comfort and guidance you need to stay the investment course when it matters most, which coincidentally tends to be when doing so feels the least comfortable.

FEATURED PROFESSIONAL

Darin has been the CIO of Aldrich Wealth since 2004, where he spearheads the development and implementation of the firm’s investment philosophy, guides the investment committee, and co-manages the private wealth team. Darin has made over 50 appearances as a guest on CNBC Power Lunch and has been quoted in several publications, including The Wall…

Darin's EXPERTISE

- Series 7 and 63 security exams

- Chartered Financial Analyst (CFA®)