2021 couldn’t come fast enough as the dawn of a new decade ushered in a renewed sense of hope and optimism. Although it was a difficult year, 2020 witnessed exceptional efforts by the Federal Reserve in the depths of the March market decline to ward off a more perilous outcome. Their efforts, combined with increased investor confidence, brought the prices of many financial instruments back to, or above, their pre-pandemic levels. The fixed income market was no exception. Bond yields in both investment-grade and riskier, high-yield markets have recovered. Investment-grade bond yields are near all-time lows, and high-yield bond spreads, the incremental return investors demand in excess of Treasuries, returned to pre-COVID levels despite increasing defaults.

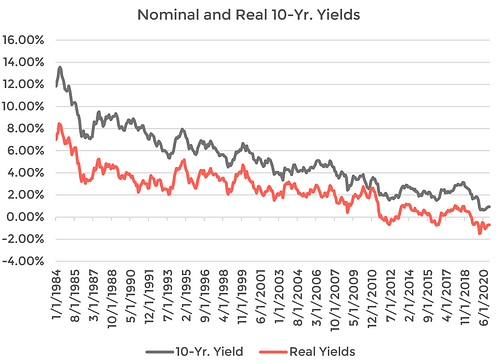

Fixed income, which primarily serves the functions of providing stable income and hedging against equity market downturns, has less to offer investors today than ever before. The chart below shows the decline in yields for the 10-year Treasury bond, which began in the early 1980s. Currently, the 10-year Treasury yield is near its lowest level dating back to 1958. As of December 31, 2020, the real yield, which is derived by taking the yield and subtracting inflation, is negative 0.72%. This trend implies that bond holders are losing purchasing power as the interest payments are worth less each year after inflation is considered. Historically, bond investors have received an average real yield of 2.27%.

Low yields, combined with the prospect of higher inflation, have many investors struggling to navigate a market where bonds offer little, if any, return potential for the next few years. Although there is no easy solution, investors may want to consider modifying their portfolios to better navigate this low and potentially rising rate environment. The following are some options that may improve portfolio returns during this low-rate period.

Q2 2025 Market Commentary + Outlook