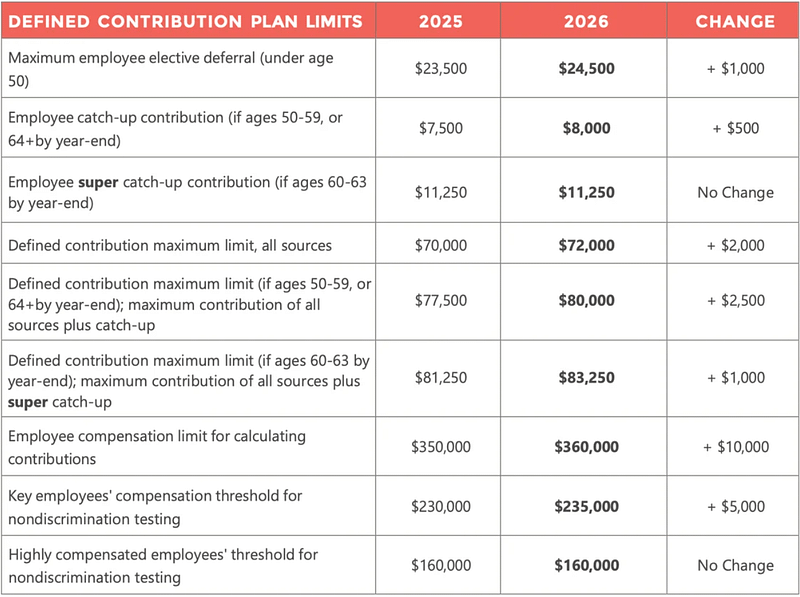

The IRS has released Notice 2025-67 highlighting the changes for 2026 Plan Limits.

We’ve summarized the most relevant 2026 plan limits for your employees below and linked them here.

The full update for you as the Plan Sponsor is summarized below and in the 2026 IRS Plan Limits document linked here.

NEW FOR 2026 – The SECURE Act 2.0 introduced a new Roth catch-up rule – employees aged 50+ earning more than $150,000 in the prior year must make catch-up contributions as Roth.

Disclosure: This content is for informational purposes only and not investment advice.