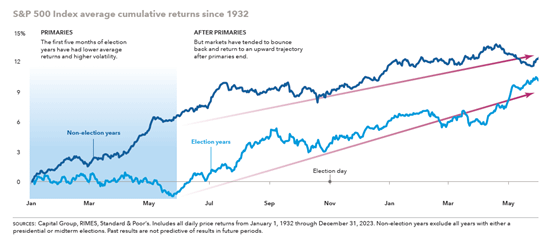

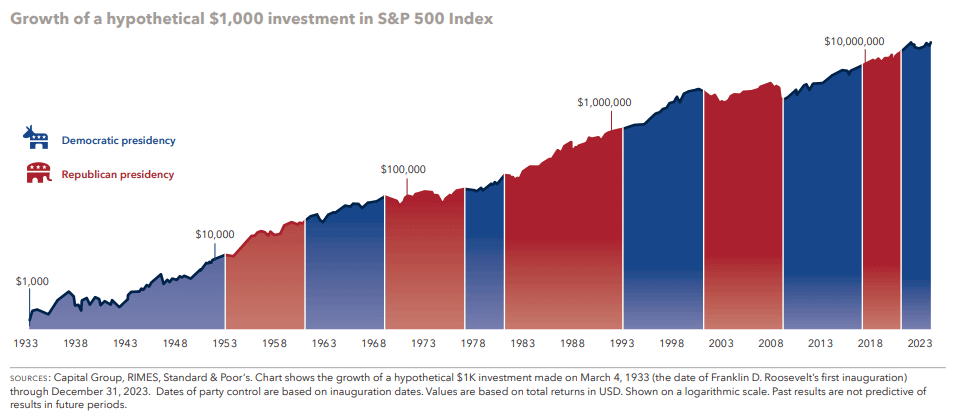

Every four years, campaigns for the Oval Office stir up strong sentiments, not only about politics but also about the investment markets.

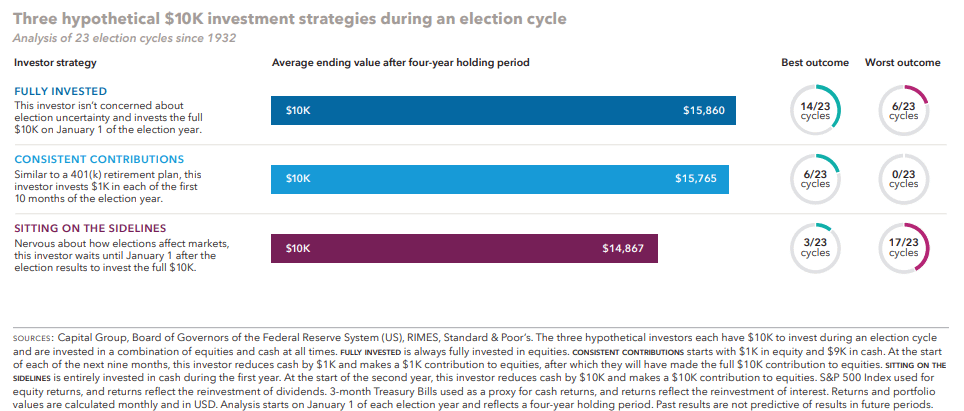

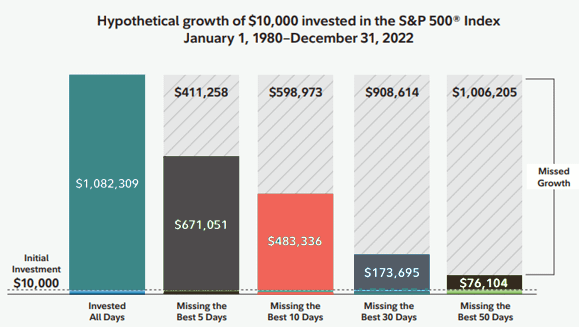

During the last election cycle, one of our clients found himself grappling with his options at the polls as well as with the market’s increased volatility. Concerned about the potential impact on his investments, he contemplated selling his assets to prevent significant losses. By talking through what to expect both in the lead-up to, and following the election, we reassured him about the normalcy of market fluctuations during election periods, enabling him to stay invested and benefit from the post-election market recovery.

With the 2024 election approaching, we decided to address election-year expectations so that you can be confident in staying the course.