The biggest risk during a volatile market isn’t the market itself, it’s how we react to it. It’s not just the red numbers on the screen. It’s the endless push notifications, the flashing headlines, and the anxious tones in everyday conversations. Fear doesn’t just creep in – it surrounds us.

Volatility makes your investment portfolio feel as if you are on a plane going through turbulence. Every bump feels catastrophic, even though the aircraft is built to endure it and the destination hasn’t changed. Even the most seasoned investors feel the magnetic pull of uncertainty. And behind it is a deeper force: the human urge to do something.

Why We’re Wired to React

If your house were on fire, you’d act without hesitation. That’s instinct. You’d grab the extinguisher, call 911, and get everyone out. Doing nothing would feel negligent, dangerous even.

But market volatility isn’t a house fire. It’s a storm.

It’s expected. It’s temporary. And most of all, it’s survivable – if you stay calm.

Unfortunately, your brain doesn’t always know the difference. When we perceive danger, the emotional center of the brain, the amygdala, takes over. It overrides the more rational, planning-oriented prefrontal cortex and your brain’s priority shifts from strategy to survival. We’re not wired to optimize 20 or 30-year outcomes, we’re wired to avoid perceived threats in the present moment.

That’s where action bias kicks in: the impulse to do something to feel in control. When investing, that often means making comfort-based decisions like moving to cash, chasing recent winners, or selling out of the market completely. These decisions can feel safe in the moment but can come at a steep long-term cost. For example, it’s common for investors to move to cash after a market drop, locking in losses that might have otherwise recovered.

Cycles Aren’t Surprises – They’re Expected

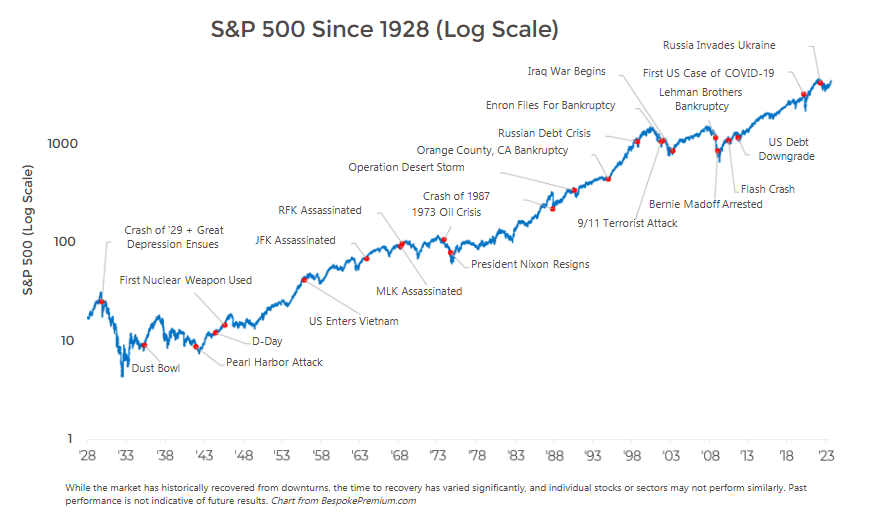

Markets go through cycles. They always have. Since 1928, the S&P 500 has experienced a 10% decline (a correction) roughly every 19 months. Bear markets, defined as a 20% or greater drop, have occurred approximately every 3.5 years, with an average decline of 33.5% and an average duration of about 9.6 months.

And yet, each time it happens, the refrain is the same: “This time is different.”

It’s not.

As Morgan Housel, former Wall Street Journal columnist and author of The Psychology of Money, puts it:

“Every past market crash looks like an opportunity, but every future market crash looks like a risk.”

The truth is, our fear isn’t based on data, it’s based on experience. A 10% drop doesn’t just appear as a number on a screen – it feels like failure. And that spike in emotion creates the illusion that taking action is wise. But reacting to that fear is often far more damaging than the drop itself.

Emotional Behavior Comes at a Cost

This is where behavioral finance, the study of how emotions and psychology influence financial decisions, tells a clear story about investor behavior. The average investor underperforms the very funds they invest in, not because of what they own, but because of when they choose to own it. Research shows the average investor underperforms the market by 3–5% annually, simply due to poor timing decisions.

Why? Because investors tend to buy when markets feel good and sell when they feel scared.

But fear-based decisions are usually backward-looking. The stock market, on the other hand, is always forward-looking. By the time it feels safe to get back in, the recovery is already well underway.

The Hidden Cost of Missing the Best Days

Some might say, “I’d rather miss out on a little upside than experience the downside.”

But data doesn’t support that logic.

Missing the 10 best days in the market over a 20-year period could cut your total return in half. Notably, most of those best days happen within days of the worst ones. Take April 8th, for example. After four straight trading days in which the S&P 500 fell 12.61%, the index surged 9.52% in a single day – its largest one-day gain since 2008 and the third-largest daily gain since World War II.

What Should You Do?

The answer isn’t to suppress emotion, it’s to build systems that account for it.

Recognize that fear is a natural part of investing. But understand that successful investors have emotions – they anticipate them and put guardrails around them, which include:

- Having a well-constructed financial plan before volatility strikes

- Maintaining a diversified portfolio based on your needs and time horizon

- Taking advantage of volatility through tax-loss harvesting and rebalancing opportunities

- Working with a wealth advisor who can be as much a behavioral coach as a financial one

Trying to time the market may feel proactive, but investing is not about making short-term moves. It’s about staying committed to a long-term strategy. Those who succeed are the ones who stay disciplined, especially when uncertainty is at its highest.

You don’t need to respond to every headline or react to every market drop. You just need a plan you trust, and the discipline to stick with it. In times like these, stillness is often the most powerful move you can make.

Disclosure: This content is for informational purposes only and not investment advice. Past performance is not indicative of future results. Market data cited is based on sources believed to be reliable but is not guaranteed.

Q4 2025 Market Commentary + 2026 Outlook